All Categories

Featured

Table of Contents

The swelling sum is determined to be the existing worth of payouts, which implies it would be much less than if the recipient continued the remaining payments. As an alternative, allow's say the proprietor picked a joint income, covering the proprietor's and a partner's lives. The owner can pick a feature that would continue repayments of 100% to the making it through spouse or select a different portion, such as 50% or 75% of the initial settlement.

As an exemption to the five-year regulation, the internal revenue service additionally enables you to stretch the settlements out over a period not exceeding your life expectations. This option may not be readily available in all agreements, nonetheless, and it isn't readily available when the recipient isn't a living person, such as a trust fund or charity.

Spouses and certain various other beneficiaries have additional alternatives. If you pick this option, you can proceed with the initial terms of the annuity contract as though the annuity were your very own.

To comprehend the tax effects of acquired annuities, it's essential to first understand the difference between certified and nonqualified annuities. The difference between these 2 kinds of annuities isn't due to agreement terms or framework yet just how they're purchased: Certified annuities are bought with pretax bucks inside of retired life accounts like.

Payments from nonqualified annuities are just partially taxable. Considering that the cash utilized to acquire the annuity has already been taxed, only the section of the payment that's attributable to incomes will be included in your income. Just how you select to get the survivor benefit is additionally a consider figuring out the tax obligation ramifications of an acquired annuity: Taxes of lump-sum payments.

Is an inherited Retirement Annuities taxable

Tax of settlement streams. When the fatality advantage is paid out as a stream of settlements, the tax liability is spread out over multiple tax years.

For a qualified annuity, the whole settlement will be reported as taxed. If you inherit an annuity, it's important to consider tax obligations.

Are Guaranteed Annuities death benefits taxable

Inheriting an annuity can give an outstanding chance for you to make development toward your objectives. Prior to you determine what to do with your inheritance, believe concerning your objectives and exactly how this cash can assist you accomplish them. If you already have an economic plan in area, you can start by examining it and taking into consideration which goals you might wish to prosper on.

Everyone's scenarios are various, and you require a plan that's personalized for you. Get in touch with a to review your concerns about inheritances and annuities.

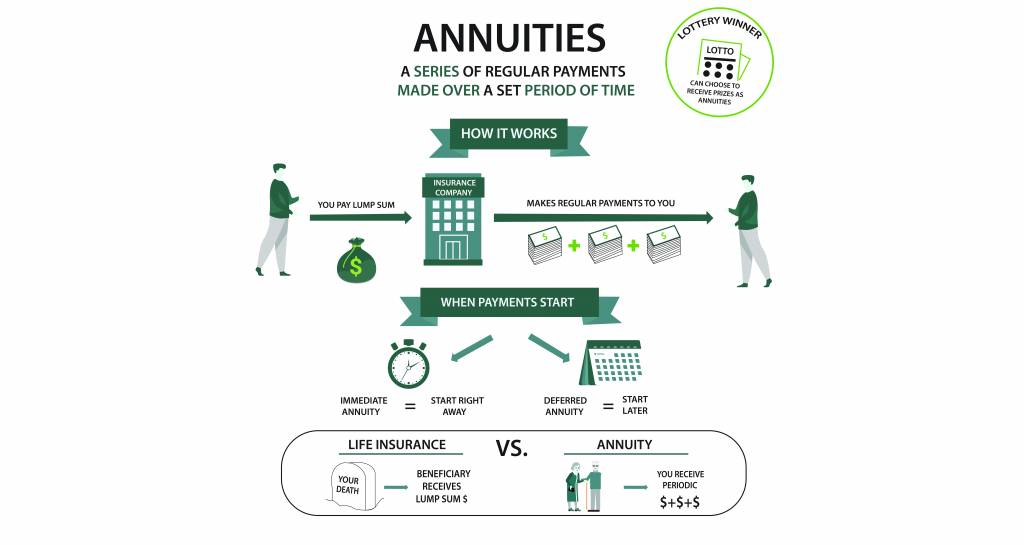

Discover why annuities need recipients and just how acquired annuities are handed down to beneficiaries in this write-up from Protective - Deferred annuities. Annuities are a means to make sure a routine payment in retired life, but what takes place if you die prior to or while you are receiving settlements from your annuity? This write-up will certainly clarify the fundamentals of annuity survivor benefit, including who can receive them and how

If you pass away before launching those payments, your loved ones can collect money from the annuity in the kind of a survivor benefit. This ensures that the beneficiaries gain from the funds that you have saved or purchased the annuity contract. Recipients are essential because they accumulate the payment from your annuity after you die.

!? The annuity death benefit uses to recipients independently of the will. This suggests the annuity benefit goes to the most just recently marked primary beneficiary (or the secondary, if the main beneficiary has actually died or is incapable of accumulating).

Tax consequences of inheriting a Annuity Contracts

That makes it extra complicated to get the annuity funds to the intended person after you pass. In many states, an annuity without a beneficiary becomes component of your estate and will certainly be paid according to your will. That involves a probate process, in which a departed individual's residential property is assessed and their will certainly validated before paying any kind of impressive taxes or financial obligations and after that dispersing to beneficiaries.

It is very challenging to challenge a standing contract, and bench for confirming such a situation is incredibly high. What occurs to an annuity upon the fatality of an owner/annuitant depends on the kind of annuity and whether or not annuity payments had actually initiated at the time of fatality.

If annuity repayments have started, whether or not settlements will continue to a called recipient would depend on the type of annuity payment chosen. A straight-life annuity payout will spend for the life of the annuitant with settlements stopping upon their fatality. A period-certain annuity pays for a particular time period, indicating that if the annuitant dies throughout that time, payments would pass to a recipient for the rest of the specified period.

Table of Contents

Latest Posts

Decoding How Investment Plans Work Key Insights on Variable Annuity Vs Fixed Annuity What Is Fixed Income Annuity Vs Variable Annuity? Features of Variable Vs Fixed Annuity Why Variable Vs Fixed Annui

Analyzing Strategic Retirement Planning Key Insights on Your Financial Future Breaking Down the Basics of Investment Plans Features of Annuities Variable Vs Fixed Why Annuities Fixed Vs Variable Matte

Exploring the Basics of Retirement Options Key Insights on Your Financial Future Defining the Right Financial Strategy Pros and Cons of Various Financial Options Why Fixed Income Annuity Vs Variable A

More

Latest Posts