All Categories

Featured

2 people purchase joint annuities, which provide a surefire income stream for the rest of their lives. If an annuitant passes away throughout the distribution period, the staying funds in the annuity may be passed on to a marked recipient. The specific choices and tax ramifications will certainly depend on the annuity contract terms and suitable laws. When an annuitant dies, the passion gained on the annuity is handled differently depending upon the kind of annuity. With a fixed-period or joint-survivor annuity, the interest proceeds to be paid out to the surviving beneficiaries. A death benefit is a function that guarantees a payout to the annuitant's beneficiary if they pass away prior to the annuity settlements are tired. Nevertheless, the accessibility and terms of the fatality advantage may differ depending upon the specific annuity contract. A kind of annuity that stops all repayments upon the annuitant's fatality is a life-only annuity. Recognizing the terms and problems of the survivor benefit prior to purchasing a variable annuity. Annuities go through taxes upon the annuitant's fatality. The tax obligation treatment relies on whether the annuity is kept in a qualified or non-qualified account. The funds go through income tax obligation in a certified account, such as a 401(k )or individual retirement account. Inheritance of a nonqualified annuity usually causes taxation just on the gains, not the whole amount.

If an annuity's designated beneficiary passes away, the outcome depends on the particular terms of the annuity agreement. If no such recipients are marked or if they, also

have passed have actually, the annuity's benefits typically revert to return annuity owner's proprietor. If a beneficiary is not named for annuity advantages, the annuity proceeds generally go to the annuitant's estate. Annuity income.

What taxes are due on inherited Variable Annuities

This can give better control over exactly how the annuity advantages are dispersed and can be component of an estate planning method to take care of and protect properties. Shawn Plummer, CRPC Retirement Planner and Insurance Policy Agent Shawn Plummer is a certified Retirement Coordinator (CRPC), insurance coverage representative, and annuity broker with over 15 years of firsthand experience in annuities and insurance policy. Shawn is the owner of The Annuity Specialist, an independent on-line insurance coverage

agency servicing consumers across the USA. Via this system, he and his team objective to remove the guesswork in retirement preparation by aiding people find the ideal insurance protection at one of the most affordable prices. Scroll to Top. I comprehend all of that. What I do not understand is exactly how in the past getting in the 1099-R I was showing a reimbursement. After entering it, I currently owe tax obligations. It's a$10,070 difference in between the refund I was anticipating and the tax obligations I currently owe. That seems really severe. At most, I would have expected the refund to reduce- not totally disappear. An economic consultant can help you choose how finest to manage an inherited annuity. What happens to an annuity after the annuity proprietor passes away depends upon the regards to the annuity agreement. Some annuities simply stop distributing earnings payments when the proprietor dies. In several situations, nevertheless, the annuity has a survivor benefit. The beneficiary may receive all the staying cash in the annuity or an ensured minimum payout, typically whichever is higher. If your moms and dad had an annuity, their contract will certainly specify who the recipient is and may

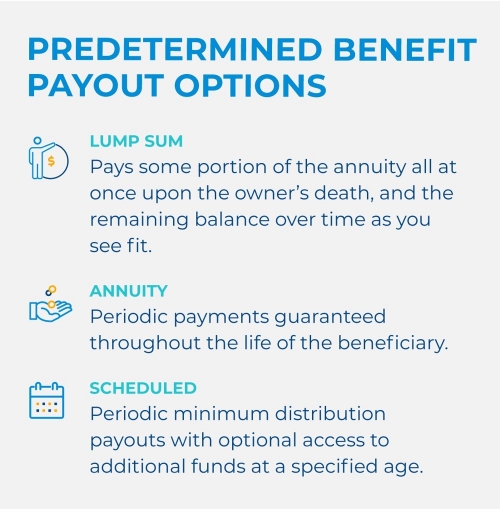

likewise have info concerning what payment alternatives are available for the survivor benefit. Practically all inherited annuities are subject to tax, yet exactly how an annuity is strained relies on its type, beneficiary status, and repayment structure. Typically, you'll owe taxes on the distinction in between the first premium utilized to purchase the annuity and the annuity's value at the time the annuitant passed away. So, whatever part of the annuity's principal was not already exhausted and any kind of revenues the annuity accumulated are taxable as earnings for the beneficiary. Non-qualified annuities are bought with after-tax bucks. Income payments from a qualified annuity are treated as taxed earnings in the year they're received and have to comply with needed minimal distribution guidelines. If you inherit a non-qualified annuity, you will only owe taxes on the earnings of the annuity, not the principal made use of to acquire it. On the other hand, a round figure payout can have serious tax effects. Because you're getting the whole annuity at the same time, you must pay taxes on the whole annuity because tax year. Under certain scenarios, you might be able to surrender an inherited annuity.

into a pension. An acquired IRA is a special retired life account used to distribute the possessions of a dead individual to their recipients. The account is registered in the dead person's name, and as a recipient, you are incapable to make additional payments or roll the inherited IRA over to another account. Just certified annuities can be rolledover right into an inherited IRA.

Latest Posts

Decoding How Investment Plans Work Key Insights on Variable Annuity Vs Fixed Annuity What Is Fixed Income Annuity Vs Variable Annuity? Features of Variable Vs Fixed Annuity Why Variable Vs Fixed Annui

Analyzing Strategic Retirement Planning Key Insights on Your Financial Future Breaking Down the Basics of Investment Plans Features of Annuities Variable Vs Fixed Why Annuities Fixed Vs Variable Matte

Exploring the Basics of Retirement Options Key Insights on Your Financial Future Defining the Right Financial Strategy Pros and Cons of Various Financial Options Why Fixed Income Annuity Vs Variable A

More

Latest Posts